How to Effectively Use Your TFSA and RRSP

(Six-minute read time)

Building a strong financial foundation for a prosperous future in Canada is certainly achievable, but it requires an understanding of the tools available and how to use them. TFSAs and RRSPs are two such tools, and we’ve created a guide to help you determine how to best use these accounts in order to reach your financial goals.

Both a Tax-Free Savings Account (TFSA) and a Registered Retirement Savings Plan (RRSP) are valuable to a Canadian’s financial portfolio. Let's go over the similarities, differences, and potential of both account types so that you can effectively use your TFSA and RRSP to create a sound financial strategy and build wealth in Canada.

TFSAs and RRSPs: The Basics

A Tax-Free Savings Account is a general-purpose savings account that allows the account holder to make contributions each year and withdraw funds at any given time. Every Canadian resident 18 years of age or older and with a valid SIN can open a TFSA.

TFSAs are registered, tax-advantaged accounts. While contributions to a TFSA are not tax-deductible, the value inside the TFSA grows tax-free and the account owner can withdraw funds at any time and avoid paying taxes on those withdrawals.

A Registered Retirement Savings Plan (RRSP) is a savings account registered with the Canadian federal government, designed to help Canadians save for a comfortable retirement. There’s no minimum age to open an RRSP account in Canada.

Funds contributed to an RRSP are exempt from being taxed in the year of the contribution, and any investment income earned from investments within the RRSP can grow tax-deferred inside the RRSP. Any money within an RRSP is taxed at the time of withdrawal.

Contribution Limits for TFSA and RRSP

TFSAs and RRSPs function a little bit differently when it comes to contributions.

TFSAs come with a set contribution amount for each year. The allotted contribution room for a TFSA begins accumulating the year that the account holder turns 18, even if the account is opened years later. Since the TFSA only came into existence in Canada in 2009, the contribution room for those who turned 18 prior to the year 2009 has been accumulating contribution room since the account type’s inception in 2009.

Here are the yearly TFSA contribution limits from 2009 to 2024:

The Canadian Revenue Agency (CRA) tracks your TFSA contribution room for you, which can be accessed on the CRA My Account Website here. However, make note that there can be a delay between the figure shown by the CRA and the actual contribution limit available to you if you have recently made a deposit or a withdrawal.

Contribution limits for RRSP accounts, however, are based on the income of the account owner. Generally, the RRSP contribution room is 18% of the earned income reported on the tax return of the previous year, up to a specified maximum. That maximum is a CRA-determined maximum contribution where, even if 18% of your income from the previous year exceeds that number, you may only contribute the CRA-determined maximum.

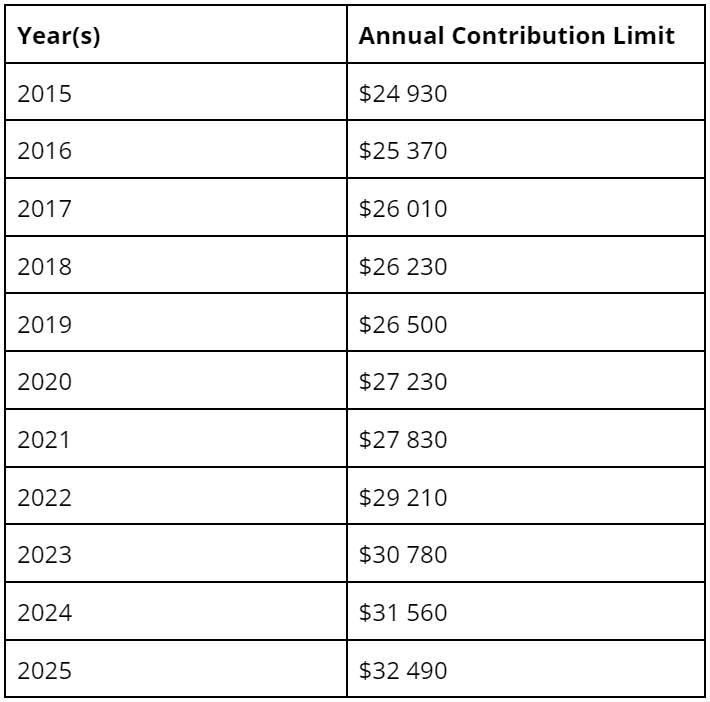

Here are the maximum yearly RRSP contribution limits from 2015 to 2025:

Pension adjustments can also affect a person’s RRSP contribution room.

For both TFSAs and RRSPs, any unused contribution room is carried forward and added to the next year’s contribution limit. Any money earned through investments in either account type does not affect the contribution limit.

Overcontributing to a TFSA or RRSP comes with penalties, so be sure to keep track of your contribution room and the amounts contributed in order to avoid incurring penalties. Your financial advisor will be able to help guide you in this and ensure that all TFSA and RRSP activity is within the limits established by the CRA.

Withdrawals for TFSA and RRSP

Funds contributed to a TFSA are taxed at the time of contribution, but they are not taxed when the funds are withdrawn. Any investment income gained within the TFSA may also be withdrawn tax-free.

When you make a withdrawal from a tax-free savings account, the amount withdrawn is then regained as contribution room the following year.

Funds contributed to an RRSP are tax-deductible at the time of contribution, but they are taxed upon withdrawal (as well as any funds gained through investments within the RRSP).

A person’s RRSP reaches maturity on the last day of the calendar year that person turns 71. At this point, the RRSP funds can be accessed through three maturity options: a lump sum withdrawal, converting to a Registered Retirement Income Fund (RRIF), or purchasing an annuity.

Should you decide to withdraw from an RRSP before reaching maturity, here are the implications to be aware of:

You must pay a withholding tax. This amount varies depending on the amount withdrawn and the account owner’s province of residence.

You must pay income tax. Withdrawals are reported on your tax return as income.

You impact your tax-deferred compounding. Since RRSP contributions can compound over time, making even a minor withdrawal may impact your savings down the road.

You lose contribution room. Funds withdrawn from an RRSP do not regenerate as contribution room the following year. That contribution room is permanently lost.

Funds may be withdrawn from an RRSP and tax-deferred if the funds are used to either purchase a first home or finance education through the Home Buyers’ Plan (HBP) or Lifelong Learning Plan (LLP) respectively.

How to Find My TFSA Contribution Limit After I Make Withdrawals?

A Tax-Free Savings Account (TFSA) offers flexibility by allowing withdrawals to be re-added as contribution room in the following year. To calculate your TFSA contribution limit, start with the yearly limit, which for 2024 is $7,000, and add any unused room from previous years. If you make a withdrawal, that amount is re-added to your contribution room in the next calendar year.

For example, if your total contribution room is $7,000 in 2024 and you deposit $5,000, you would have $2,000 of contribution room left for that year. If you then withdraw $2,000, your remaining contribution room stays at $2,000 for 2024, but in 2025, the $2,000 you withdrew will be re-added, increasing your contribution room for the next year.

To calculate your own limit, check your available contribution room with the CRA and factor in any withdrawals to plan for the following year.

To find your TFSA contribution limit, you can check your Notice of Assessment (NOA) from the Canada Revenue Agency (CRA) or log in to your CRA My Account portal.

TFSA vs. RRSP: Which to Use?

When deciding where to allot your funds, there are a few things to consider.

Think about your tax rate. If your tax rate at the time of contribution is higher than your tax rate will be at the time of withdrawal, an RRSP is likely the superior choice and will deliver a higher net rate of return. If your current tax rate is lower than when you plan to withdraw funds, a TFSA will provide a higher return.

Income-tested benefits and credits should also be considered. Placing funds in a TFSA has no impact on federal income-tested benefits like the Canada Child Benefit, Old Age Security, or Guaranteed Income Supplement. If you’re in a low tax bracket, it’s generally sound to prioritize contributing to a TFSA over an RRSP.

In general, RRSPs are most effective when used for retirement savings while TFSAs can be used to save for retirement as well as other, shorter-term purchases. TFSAs are better suited to those shorter-term purchases compared to RRSPs because any withdrawals made from a TFSA are regained as contribution room the following year, whereas the same is not true for RRSP withdrawals. However, while there is no penalty or tax consequence to utilizing a TFSA to save for mid-sized purchases, doing so limits your ability to reap the full benefits of tax-free growth offered by a TFSA. For this reason, it’s generally better to reserve your TFSA for long-term savings and instead use a non-registered account to save for shorter-term purchases.

There are many factors to consider when it comes to determining the best path for your money: your age, current income, projected income, assets, financial goals, life goals, and so on. Staying informed regarding the rules and regulations of the various registered accounts in Canada provides you with a strong foundation that you can use to build a financial strategy and allot your funds wisely.

Working with a financial professional, however, can help to ensure that your financial decisions are well-informed, compliant with federal regulations, and effective in helping you to reach your short- and long-term financial goals. To discuss your situation and optimize your funds with a professional financial planner, book a call with us at WealthTrack today.

Recognized By

Interested in Learning More About Investing?

Check out our additional resources: